- Robinhood has announced a significant move into the cryptocurrency space by acquiring the crypto exchange Bitstamp

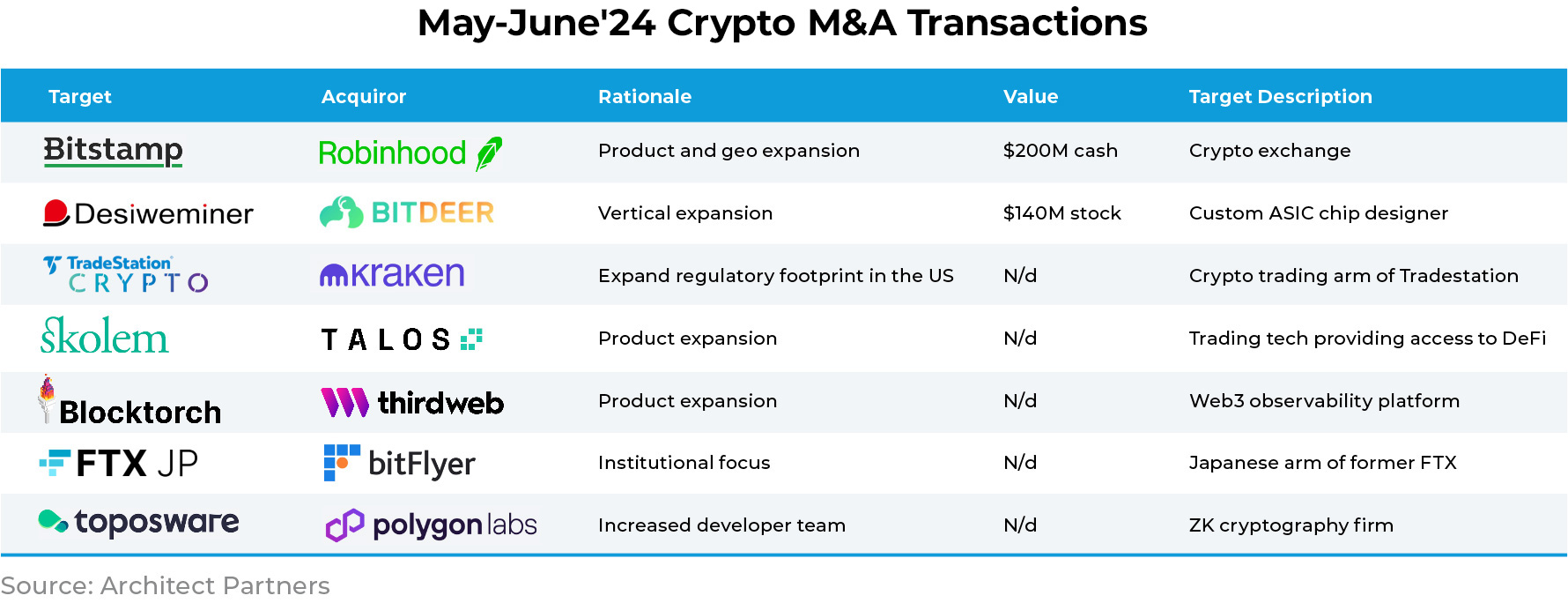

- There have been a number of smaller M&A transactions in the crypto space in Q2 that are finally starting to generate exits - Talos, Kraken, bitFlyer, and others

- US regulation sees major progress with House passing FIT 21 Act and spot ETH ETFs approval

- Consensus 2024 was one of the most significant crypto events this year with many discussions around Web3+AI, DePINs, tokenization, and crypto adoption by tradFi institutional players

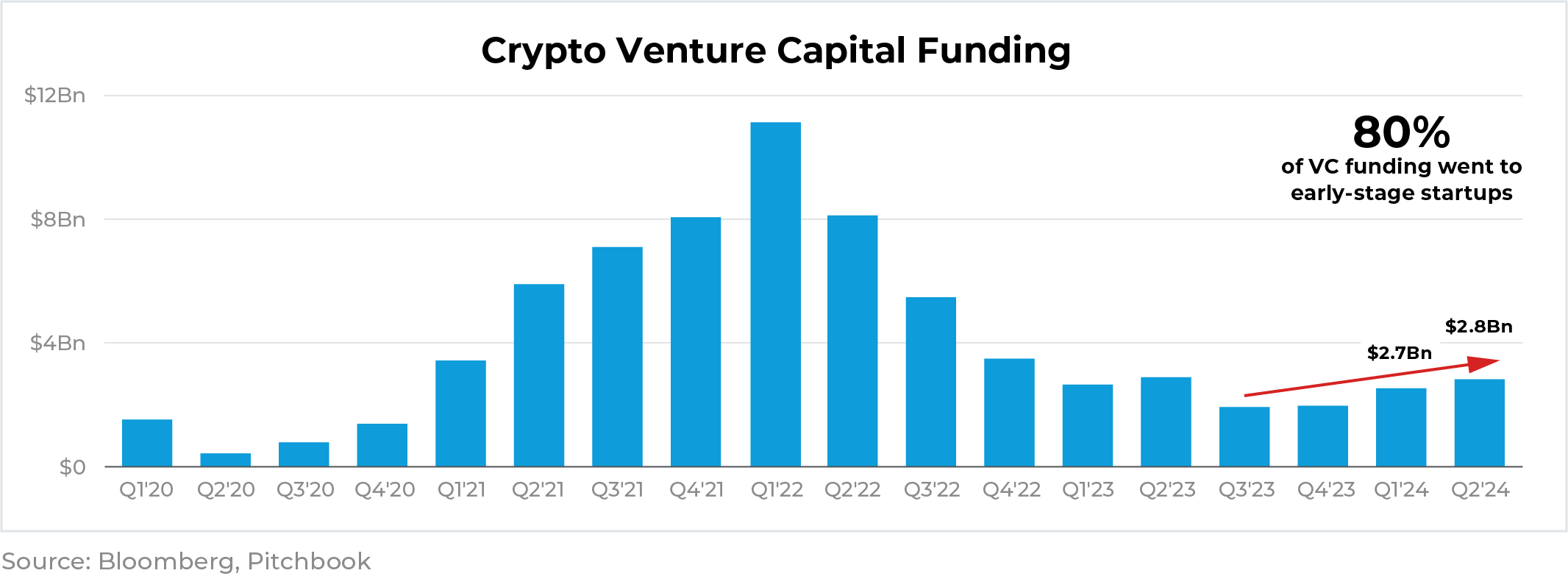

- Crypto venture capital activity in 1H 2024 rebounded, particularly for early-stage startups

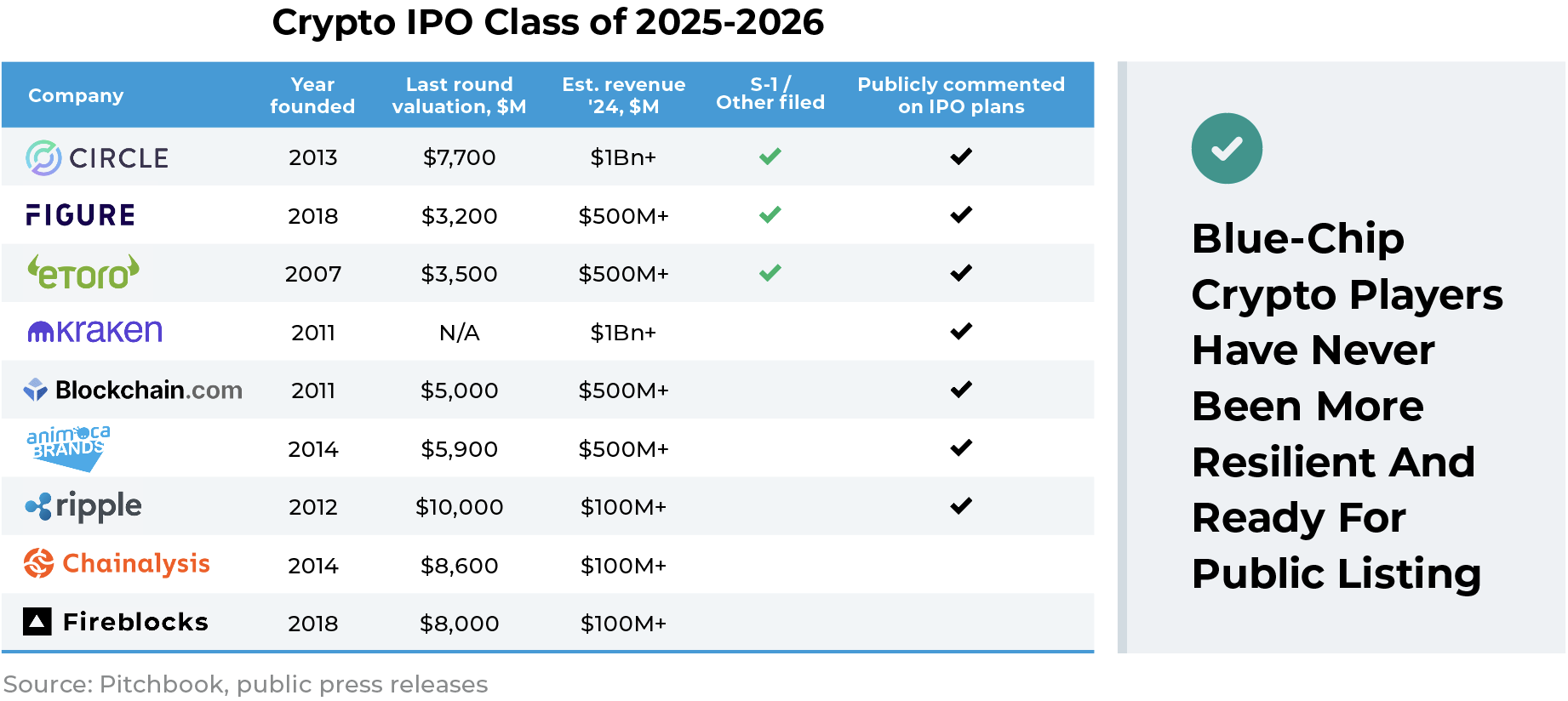

- Many scaled crypto companies are strong candidates for IPO in 2025-2026

Key Themes

M&A transactions start to generate exits: Robinhood bets big on crypto with $200M deal for Bitstamp

Trading platform Robinhood Markets (HOOD.O) agreed to buy crypto exchange Bitstamp for about $200M in cash, speeding up a broader push into digital assets with its biggest-ever deal.

The acquisition of Bitstamp, founded in 2011 and holds 50 active licenses and registrations globally, puts Robinhood in direct competition with industry giants such as Binance and Coinbase (COIN).

Robinhood's crypto business was the driving force behind a massive first-quarter earnings beat in May.

10SQ View: Robinhood, like many other tradFi and fintech players, is seeking to capitalise on a renewed wave of investor demand for digital assets. While there are many reasons why Robinhood acquired Bitstamp, one is particularly important for the company, is strategic investment into infrastructure for institutional crypto trading. We believe this is just the first of many acquisitions in the upcoming cycle leading to successful exits of many blockchain venture investments.

House passes FIT 21 Act

On May 22 2024, the Financial Innovation and Technology for the 21st Century Act (FIT 21), a market structure reform bill setting a federal regulatory framework for the crypto industry, passed the White House with bipartisan support. FIT 21 fulfills a long-standing industry demand, as it would allow most cryptocurrencies to be treated as commodities and thus regulated by the CFTC, not the SEC. The bill would still need to pass the Senate before becoming law.

10SQ View: This White House statement is a major departure from their previous statement on crypto and is a great breakthrough for the crypto industry. FIT 21 is the first bill that tries to comprehensively define how the crypto market should be regulated in the US. It tries to define terms around decentralized systems and when networks are sufficiently decentralized to no longer be a security.

SEC approves spot ETH ETFs

On May 23, 2024, the SEC approved rule change permitting the listing and trading of eight spot ETH ETFs (staking free), making ETH the second cryptocurrency to get ETF approval by the SEC. It will take some time before trading begins, as the SEC must review and approve registration statements.

NYDIG estimates the inflow for ETH ETFs to be $4.5Bn, about a third of the inflow into bitcoin ETFs. According to FalconX, the market expectation is that the ETF will attract something between 10% to 20% of the BTC inflows.

10SQ View: As bitcoin ETF legitimizes crypto as an asset class, ether ETF makes investors realize that crypto is far more exciting and asymmetric than a digital gold/macro hedge. Ether ETFs may also attract investors looking for technology exposure, which is a broader audience and bigger market, than pure-play macro investors. In any way, this surprising approval, sets the stage for increased institutional investment in the Ethereum ecosystem.

Circle CEO Jeremy Allaire - stablecoins could account for 10% of “global economic money” within the next decade

In a detailed social media post, he said he has "never been more optimistic than right now" about the future of crypto in his 11 years leading the firm behind the USDC stablecoin. "By the end of 2025, stablecoins will be "legal electronic money" almost everywhere, which sets them up to become a larger and larger portion of the $100T+ market for electronic money."

The issuer of the largest regulated stablecoin USDC, Circle plans to go public in 2025.

10SQ View: Data suggests that stablecoin adoption has risen exponentially in the past four years. In 2023, the value settled in stablecoins reached $6.8T, up 6.5x from 2020(1). Circle's stablecoin, USDC, can be the biggest beneficiary under new European guidelines, MiCA, governing digital assets that are set to take effect in July.

Animoca Brands looks to crypto-friendly markets for potential 2025 listing

Crypto game developer and investment fund Animoca Brands, valued at $5.9Bn during its last fundraise in 2022, is contemplating an IPO in 2025. Yat Siu, Animoca’s co-founder, expects the company’s 2024 revenue to double from 2023.

Animoca continues to be active in venture investments, including betting on TON, the blockchain associated with messaging app Telegram.

10SQ View: The Animoca’s intention to list signals its expectation of the broader rebound of NFT and metaverse market. Animoca joins Circle and Kraken in crypto companies reportedly looking to IPO soon.

Fox Corporation onboards TIME as first publishing partner on Polygon-based Verify Protocol

Fox Corporation has onboarded media brand TIME as its first external publishing partner on its Polygon-based Verify Protocol. TIME will use the blockchain-based media platform for its content licensing and verification strategy.

Verify Protocol seeks to establish content licensing deals with AI firms covering how media companies’ intellectual property is used and introduces potential new commercial opportunities by using smart contracts to grant access to content programmatically.

10SQ View: This is another real-life case of blockchain technology that we believe may be broadly adopted in the media and entertainment industry. Blockchain smart contracts can be used to license IP and pay royalties. Blockchains can also counter fake content with digital signature and timestamps to deter the usage of AI manipulated images. Our investment team has spoken to multiple startups raising funds that are building solutions to address these two use cases.

[1] Source: Coinmetrics

10SQ Takeaways From Consensus 2024

Consensus 2024, organized by Coindesk and held from May 29 to May 31 in Austin, Texas, is renowned for being the world’s largest and longest-running gathering in the crypto space. This year, the event brought together over 15,000 attendees from more than 100 countries, including 6,800 companies.

Key narratives discussed:

| DePIN |

|

| Web3+AI / Decentralized compute |

|

| Real-world Assets |

|

| Infrastructure building |

|

| TradFi institutions |

|

Beyond the Bubble: How VCs Are Investing in Crypto and AI

Catch up on this insightful Consensus session featuring David Pakman from Coinfund, Casey Caruso from Topology.VC, Jesus Rodriguez from IntoTheBlock, and Polina Bermisheva from TenSquared Capital.

They look past the bubble and get deep into which types of projects, sub-sectors, and use cases in the Crypto+AI space have true substance. They dive into the state of Crypto+AI, competition for AI talent, token valuations, open-source AI funding, and more.

Crypto Venture Capital Rebounds: Early-Stage Startups and Upcoming IPOs Drive Optimism

Venture capital activity in crypto is picking up for early-stage startups

The crypto market rebound in H1 2024 brought renewed optimism to the sector and the crypto venture capital market. This year, we see a much more active fundraising environment, which means more innovation and building. About 80% of the VC capital goes to early-stage startups, while 20% goes to later-stage companies.

Early-stage startups were able to source funding, particularly via tokens or equity + token structures, from crypto-focused early-stage venture funds. We have been seeing many exciting opportunities in the most innovative areas of crypto, like DePINs, AI infrastructure, social apps, tokenization, stablecoins, including sizeable early-stage rounds of Telegram, Farcaster, Polymarket, and others.

It is more difficult for later-stage crypto companies to raise capital as many large generalist venture capital firms have exited the sector or dramatically reduced their exposure.

The last ten years produced many public company scale crypto companies that continue to grow

Many sizeable crypto companies, such as Circle and Kraken have reached public company scale and are strong candidates for listing when the IPO markets re-open in full. We see 5-7 strong IPO candidates for 2025-2026 that are well positioned. For example, Circle, Figure, Kraken, and Animoca Brands have already publicly commented on their IPO plans or confidentially made filings with the SEC. This potential for major IPOs should drive investor optimism about the future of the industry. This prospective wave of IPOs will be a positive catalyst for the crypto sector and create natural acquirors for earlier stage venture backed companies.

It is worth noting how quickly these companies reached this milestone. A decade ago, Coinbase did not exist; now, it generates $2.8Bn in revenue a year. Kraken and Circle took ten years to go from zero to more than $1Bn in revenue. Having achieved scale, these companies are still growing and innovating. For example, Circle announces product and partnership developments and milestones almost daily. Adding to that, many of these companies successfully weathered the market downturn, still have significant funding runway from prior rounds, and have demonstrated strong operating performance over the last six months.

The crypto market presents abundant opportunities to invest across different stages, from early-stage rounds of emerging stars to later-stage secondary deals of pre-IPO “safe bets”.

At TenSquared Capital, we look for the best ideas across stages, with a focus on projects with proven business models, demonstrated customer demand, and revenue traction.

10SQ Team Podcasts and Conferences

Bloomberg: Crypto ‘Secondaries’ Prices Jump as Expectations of IPOs Climb

“It’s a good time to be re-evaluating secondary opportunities as many of larger crypto companies have shown strong operating performance over the last six months and the fundamentals have improved significantly,” said Stan Miroshnik, founder of TenSquared Capital. “Many of these companies still have significant funding runway from prior rounds, are again generating cash, have weathered the down market and have come out lean and focused.”

Fireside Chat with Chris Cheung of TenSquared and Matthew Richardson of Brown Rudnick

In this fireside discussion at the Brown Rudnick Global Blockchain Conference 2024, Chris and Matthew discuss the role blockchain technology can play in solving the challenges to data privacy and data integrity caused by emerging AI technologies and the legal concerns and regulations surrounding both.

Resilience in Disruption: Adapting and Thriving in Distressed Markets

The panel focused on opportunities and challenges in the recovering crypto capital market that was still largely distressed. We covered the overhang of secondaries, the complexities of workouts and restructurings, and the unique opportunities presented by the dislocations in the venture market.

VC10X Podcast: Why has Blockchain not gone mainstream yet?

Chris shares his journey in blockchain venture investing on the VC10X podcast. He discusses his investment thesis and focus areas within Web3 & crypto plus TenSquared Capital's latest investment in Superlogic.

Upcoming Events

July 25 - Bitcoin 2024 Conference in Nashville

September 18 - Token2049 in Singapore

September 30 - Messari Mainnet 2024 in New York

Opportunities to connect with the 10SQ team - book a meeting in Calendly

-

August 1st - Polina Bermisheva speaks at Web3 Investor Day in Chicago

Important Disclosures

This newsletter is provided for informational purposes only, and should NOT be relied upon as legal, business, investment, or tax advice. Furthermore, the content is not directed at nor intended for use by any investors or prospective investors in any TenSquared Capital LLC (“10SQ”) managed funds. Please see tensquared.com/disclosures.html for additional important details, including link to list of investments.