-

10SQ to launch its first dedicated Attention Economy Fund, a first of its kind investment vehicle focused on the intersection of blockchain and media & entertainment.

-

The opportunity to invest in the attention economy is unusually aligned: technology (generative AI, new distribution platforms), finance (stablecoins), culture (creators with thousands of true fans), and regulation are all converging.

-

We spent 2025 engaging with leading attention economy platforms and met an expanding group of exceptional founders building in this space. These startups emphasize durable business models and clear monetization.

-

As the year comes to a close, the team is energized by the momentum behind the fund (current and new portfolio companies) and remains optimistic about the outlook for a Web3-powered attention ecosystem.

-

We believe over the next 3-5 years we will see many new venture-scale (10X+) outcomes in this space.

The Attention Economy Is Everywhere

2025 was a defining year for the attention economy - a space that not only held strong but thrived amid constant economic shifts and technological disruption. The race for user attention hit new heights as social platforms, short-form video, creators, and AI all vied to shape how billions of people consume and connect online.

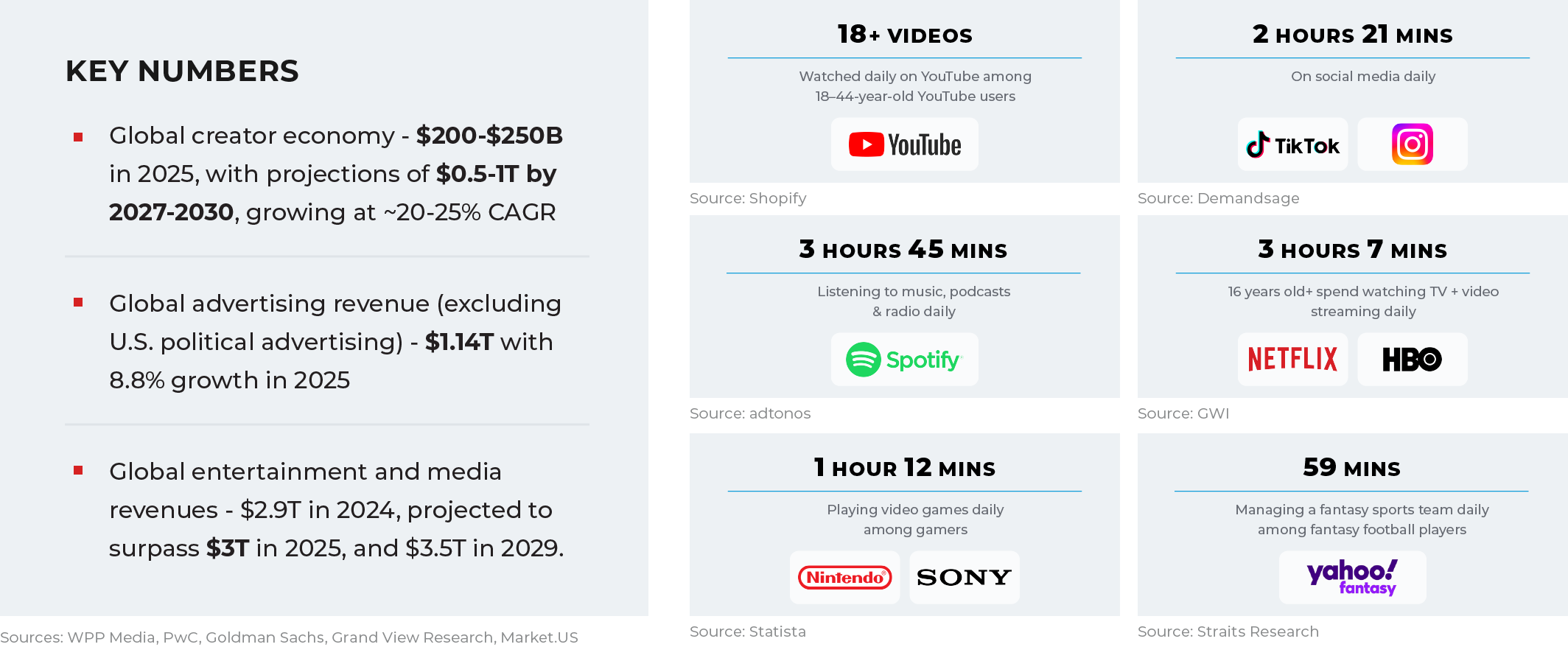

Creators firmly took center stage. For the first time, platforms like YouTube, TikTok, and Instagram are on track to overtake traditional giants like TV networks, news outlets, and radio in global ad revenue. Together, these creator-led platforms are expected to bring in about $190B in 2025, up 20% from last year, according to WPP Media. By 2030, that figure could soar to nearly $377B. Meanwhile, the broader creator economy, already valued at $200B-$250B, is scaling fast, with forecasts pointing to $0.5–1T by the end of the decade, growing roughly 20–25% annually.

This shift marks a real inflection point for the attention economy. As audiences spend ever more time in digital spaces, brands are following suit, directing budgets toward creators that build authentic relationships and cultural influence. While accessibility fuels engagement, it’s the creators’ voices that make the difference. More than ever, people trust creators not just as entertainers but as credible, relatable sources.

The Attention Economy Is Everywhere: Creators, Not Channels, Win The New Prime Time

This year, we observed several key trends in how attention is monetized:

-

Musicians and athletes increasingly expanded beyond traditional income streams, launching their own products and merchandise, signing brand sponsorships, and producing original valuable content.

-

Shifts in US name, image, and likeness (NIL) rules for college athletes further accelerated this by allowing student-athletes to actively commercialize their personal brands connecting with younger audiences.

-

Major platforms, including Meta, TikTok, YouTube, LinkedIn, and Snapchat, also made concerted efforts to support creator–brand collaborations, rolling out initiatives and tools to streamline partnerships.

-

At the same time, brands have doubled down on social-first marketing strategies. Unilever CEO Fernando Fernandez, for instance, has outlined plans to boost the company’s social media advertising share from roughly 30% to 50% (1) of total ad spend.

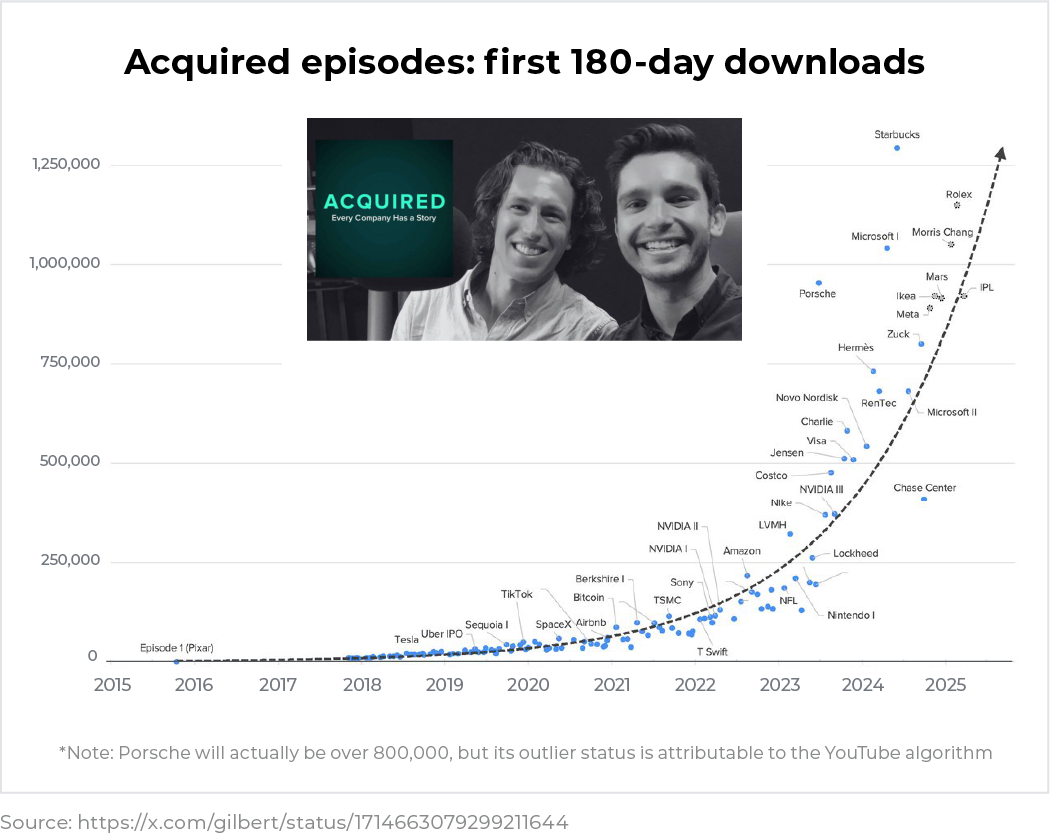

The fusion of social media, creators, and television also intensified. YouTube has firmly solidified its position as the “new TV”, with top creators matching or surpassing traditional studios in both content output and audience reach, while shows like Amazon’s Beast Games with MrBeast demonstrate creator-led IP is moving into premium, TV-style formats.

Attention media platforms continued to leverage blockchain, AI, and decentralized incentives to reward genuine participation, addressing Web2's issues like centralized control and unfair monetization.

Stablecoins emerged as the core "rails," processing trillions in volume with near-instant, low-cost settlements, challenging traditional systems like SWIFT and cards, and being widely used in creator economy.

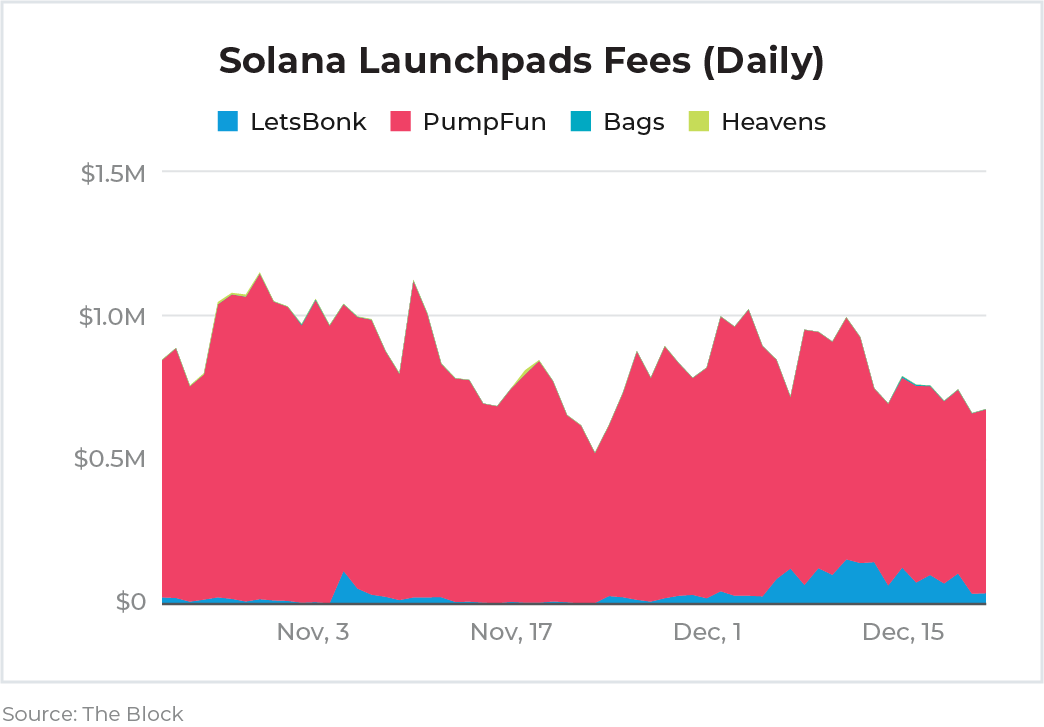

Token incentives on platforms like Pump.fun continued to play an important role.

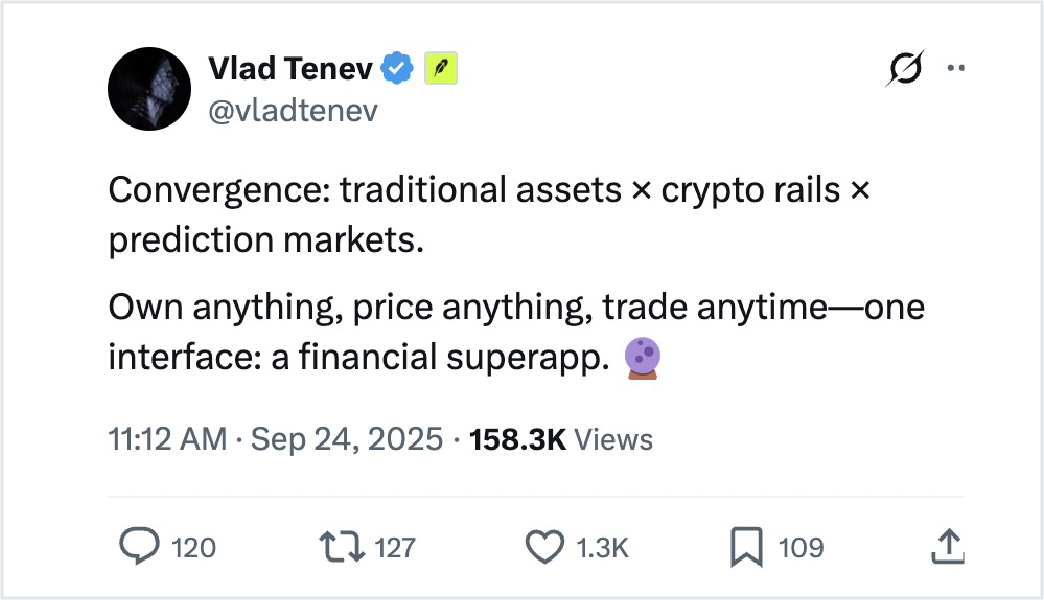

Social media and finance are increasingly merging into a single SocialFi layer, where community interaction, content, trading, betting, and investing all live within a single experience.

-

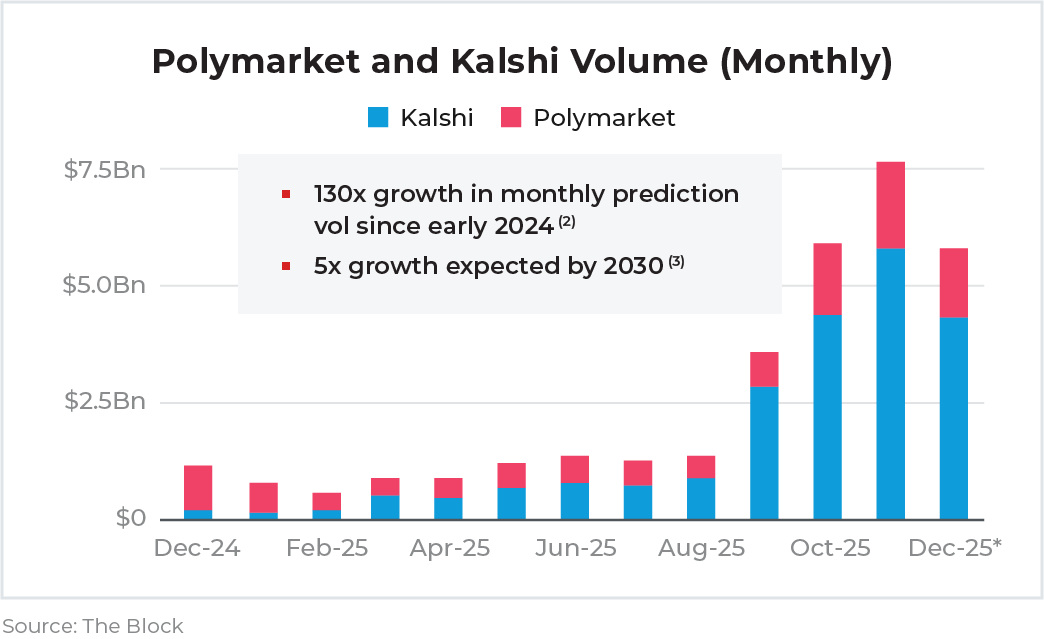

Speculation as entertainment: It is especially visible in prediction markets like Polymarket and Kalshi, as well as apps such as Robinhood, which now layer in social feeds, shared trades, and prediction-style products through partnerships. Previously expressed in altcoins, NFTs, memcoins, it has shifted to other markets with ease of use.

-

Everyone is into it: from established financial exchanges to sports betting operators and cryptocurrency platforms: Fanatics, Smarkets, International Exchange (ICE), Coinbase, Crypto.com, and Gemini.

1) https://lindseygamble.beehiiv.com/p/unilever-ceo-20x-more-influencers

2) Financial Times, The Block

3) Citizens Financial Group

The Attention Economy Is Everywhere: When Digital Attention Becomes The Main Asset Class

In 2025, attention and creator influence increasingly became tokenized, turning attention itself into a tradable asset class.

-

On Solana, Pump.fun helped pioneer “creator capital markets,” shifting from simple memecoin launches toward models where reach, influence, and virality are explicitly tokenized. According to a Dune dashboard (1), the platform has accumulated $920MM worth of fees.

-

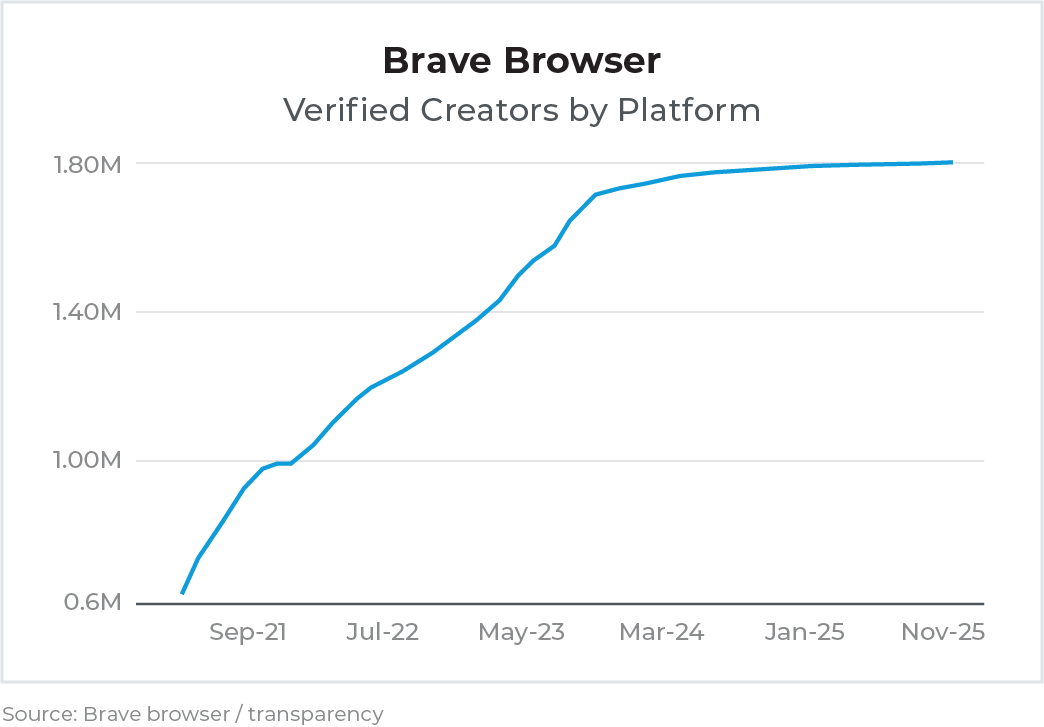

Basic Attention Token (BAT) in the Brave browser also experienced a renewed interest (46.5M DAU and 1.8M creators), underscoring a privacy-centric ad framework where users are rewarded for choosing to view ads.

-

Meanwhile, projects such as Courtyard.io, Klout.gg, Wallchain, and KapKap experimented with letting users own or trade digital objects like hashtags, trends, collectible cards, extending the idea of financialized attention.

2025 was the year when the era of AI-generated content has begun, led by major launches from Meta, OpenAI, and Google. Meta rolled out Vibes, Google has tested its own approach with Doppl, while OpenAI introduced Sora and later Sora 2, paired with a TikTok-style social platform centered entirely on AI-generated clips.

Sora 2’s rapid user growth, dramatic reductions in generation costs, and high output volume highlight both the potential for a new wave of consumer AI experiences and the rising concerns around copyright and deepfakes.

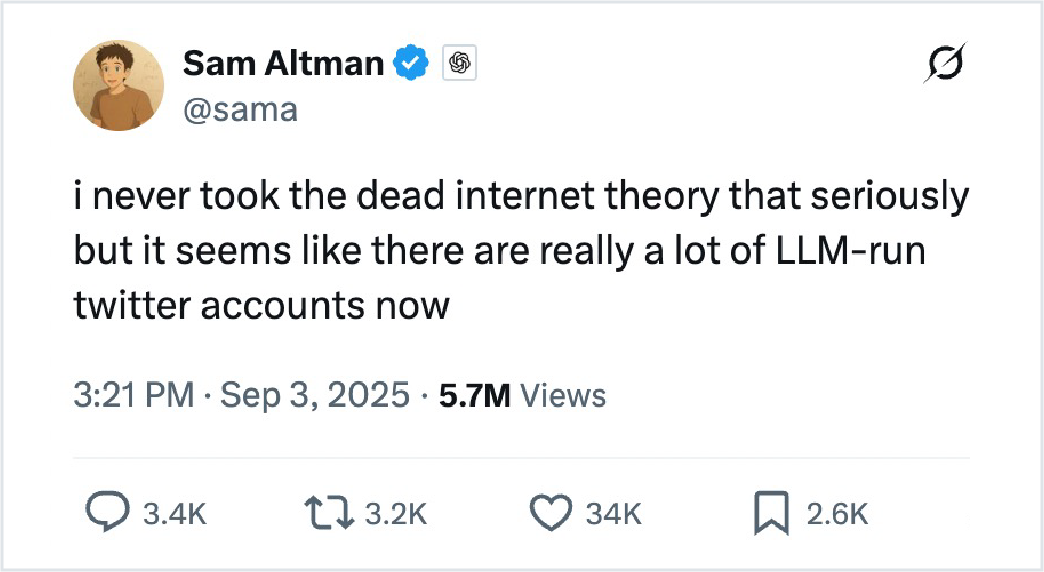

As the cost of deploying AI agents continues to drop, AI-generated content starts to dominate social platforms. Bots now outnumber humans online - human traffic dropped from 62.8% in 2019 to below 50% in 2024 (2).

Crypto-native approaches to proving that real people are using applications without exposing sensitive personal data emerge as a new foundational primitive for the next generation of internet and consumer apps.

1) @adam_tehc

2) https://wholewhale.com

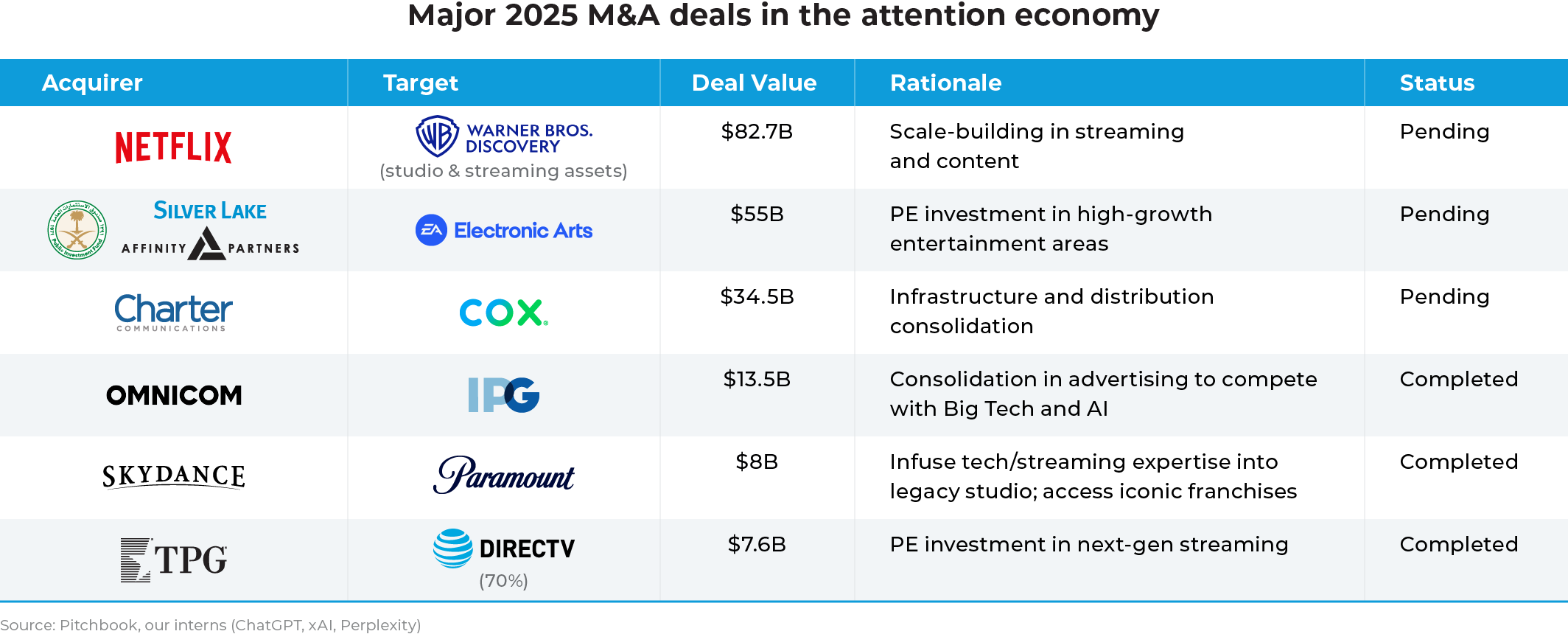

Deals and Dollars: Attention Economy Accelerates

Global attention economy industry had a landmark year for M&A (est. $200B-300B in deal vol.), it was a period of intense consolidation across streaming, content production, gaming, advertising, and distribution. Buyers raced to own the customer, the IP, and the tech, or risk irrelevance in a tech-converged landscape in the AI era.

IPO activity was dominated by ticketing/live events (StubHub) with several anticipated listings (e.g., Shein, Klarna, Discord) delayed or shifted to 2026 amid volatility. Animoca Brands, a major Web3 entertainment powerhouse, announced potential Nasdaq listing plans via reverse merger.

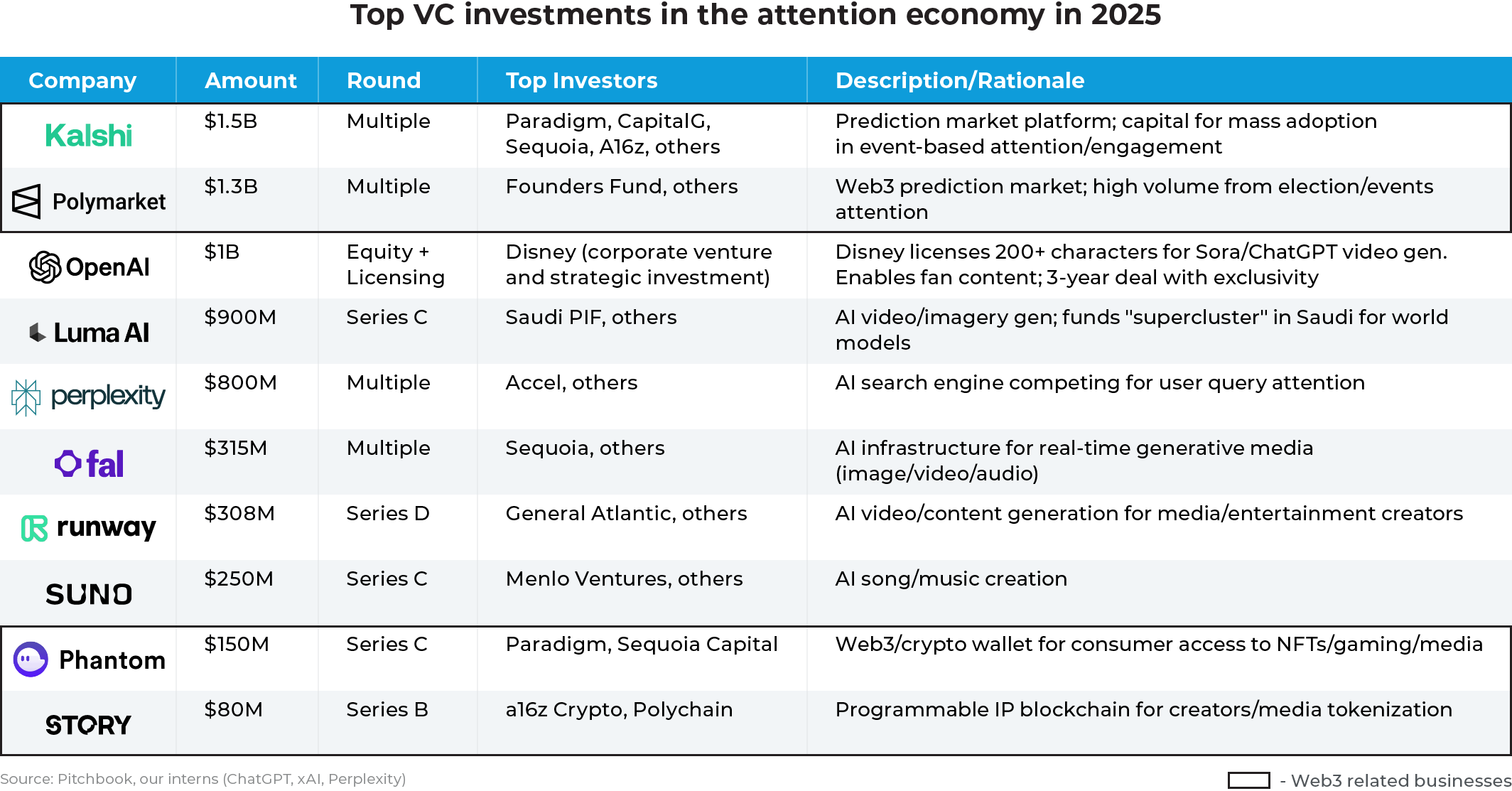

AI and Web3-driven companies in the attention economy (e.g., generative content, search, voice, creative tools that capture user time) attracted a major slice of the VC investments in 2025. These deals reflect trends toward AI tools that monetize user attention (e.g., generative content, personalized search, predictive engagement) and web3 consumer onboarding.

The attention economy is evolving at high speed as AI, Web,3 and new technologies reshape how people create and consume content. Private capital is pouring into the space, confirming market’s outsized impact, massive scale, powerful innovation and growth potential. These capital flows are also seeding the next generation of strategic buyers for 10SQ Attention Economy fund portfolio companies. We see a tremendous venture opportunity over the next 5 years.

Web2 Giants Test Web3 Attention Rails

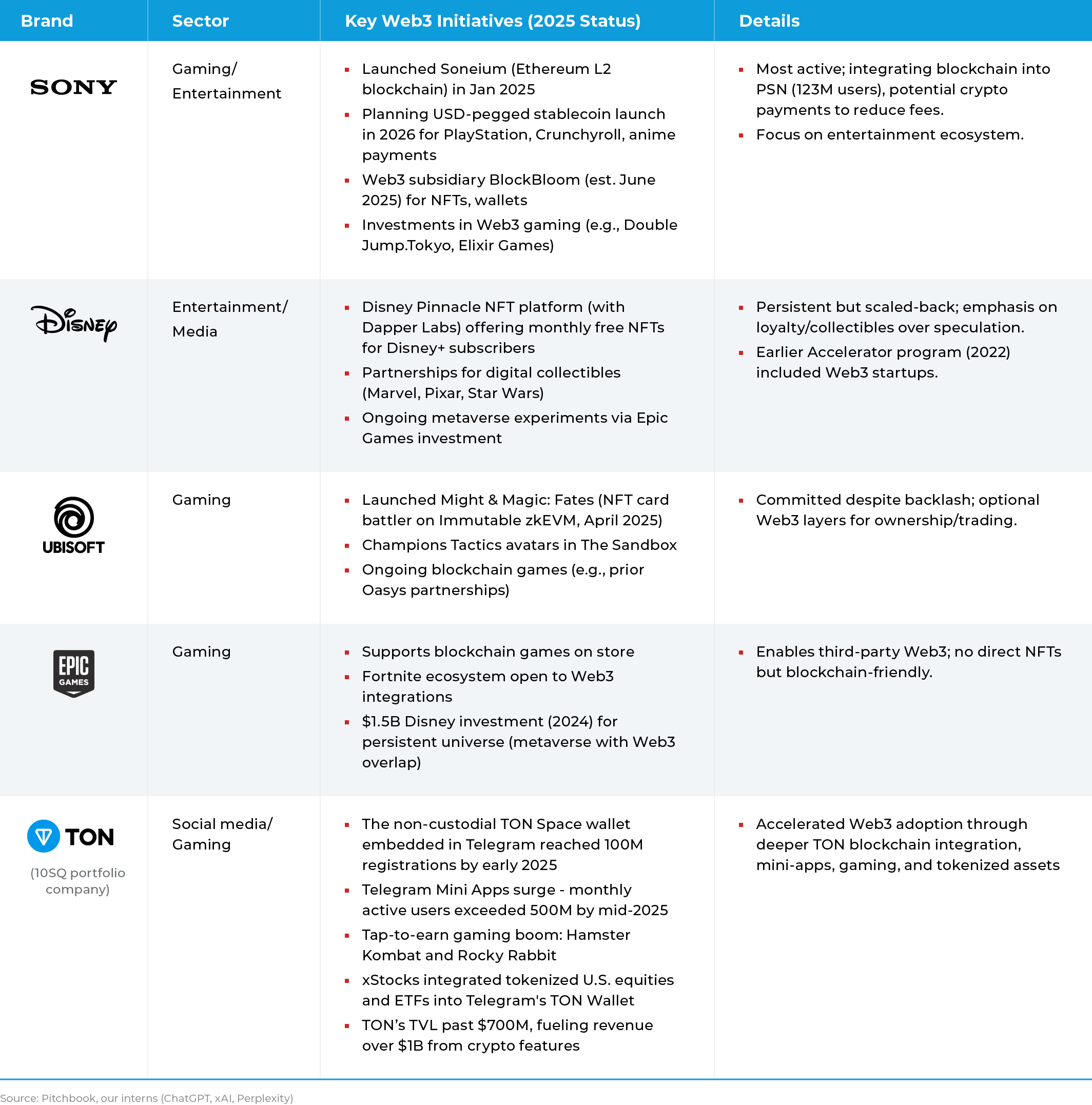

This year, traditional Web2 brands in entertainment, media, gaming, and consumer sectors have adopted a cautious yet strategic approach to Web3. While the 2021–2022 NFT hype has subsided, activity persists primarily in blockchain gaming and ecosystem building.

Many brands scaled back speculative NFT drops, focusing instead on utility-driven integrations like digital ownership, fan engagement, and payments. While gaming led the charge, with Asian companies (e.g., Sony) more active than Western ones.

In 2025, the 10SQ team logged weeks of talks with top US and Asian attention-economy giants. The mandate is unmistakable: build ecosystems, weave in stablecoins and tokenized assets, and push crypto-AI experiments. Mass blockchain adoption relies on distribution from corporates with millions of users already in place.

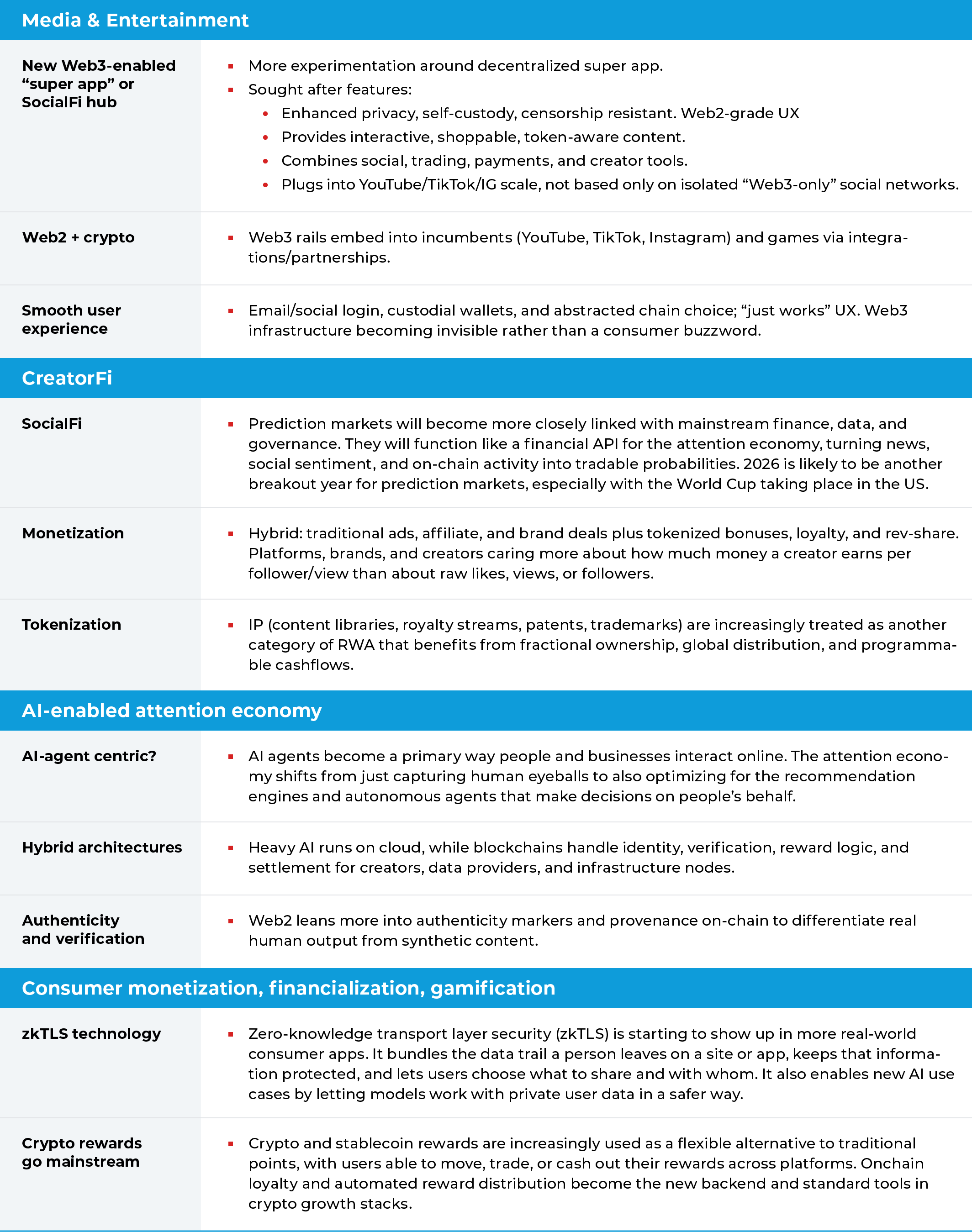

Key Web3 Attention Themes for 2026

Web3 Attention Economy Ecosystem Is Growing

This year, the team has met a growing number of founders building directly in the attention economy. Compared with prior cycles, more of these startups are pursuing sustainable business models, layering in utility-driven integrations, and prioritizing clear product monetization from the outset.

10SQ is particularly excited about new sustainable business models in creator economies, social media, gaming, prediction markets, data monetization & AI, and new forms of creator finance, loyalty, and rewards. The ecosystem is increasingly diverse and rapidly growing. Emerging winners demonstrate what becomes possible when better UX, richer incentive design, and app‑first founders meet a much larger, more mainstream market.

If you are building in the attention economy x Web3 x AI, please reach out to us.

This report is a product of the TenSquared Capital (10SQ) research team.

TenSquared Capital (10SQ) is a venture capital firm investing in the Attention Economy, where Media, IP, and Technology intersect.

Important Disclosures

This publication is an informational document only and is intended to provide educational content and general market commentary, and should NOT be relied upon as legal, business, investment, or tax advice. Furthermore, the content is not directed at nor intended for use by any investors or prospective investors in any TenSquared Capital LLC (“10SQ”) managed funds. Please visit tensquared.com/disclosures.html for additional important details and disclosures, including link to list of investments.