-

10SQ is a venture firm focused on early-stage opportunities in the blockchain-enabled Attention Economy.

-

The attention economy is a massive market, valued between $700Bn and $1Tn globally driven by billions of users across diverse platforms and powered by the creator economy, AI, and blockchain technologies.

-

Blockchain is a core enabler, delivering scalable infrastructure, decentralized ownership, and innovative business models—powering prediction markets, digital collectibles, loyalty programs, and more.

-

As institutional investment and adoption increase, the rapidly advancing intersection of blockchain and the attention economy is poised to become a major driver of Web3’s growth, much like how blockchain has transformed global finance.

Executive Summary

The emerging applications of blockchain in the attention economy and intellectual property (IP) represent a major new frontier in the Web3 market, shifting the focus from stablecoins and currency facilitation to direct value creation through user engagement.

This paradigm aligns with changing consumer and creator behavior and is poised to benefit significantly from the next wave of mass blockchain adoption, unlocking new economic models built around intangible digital property and active participation rather than mere currency exchange.

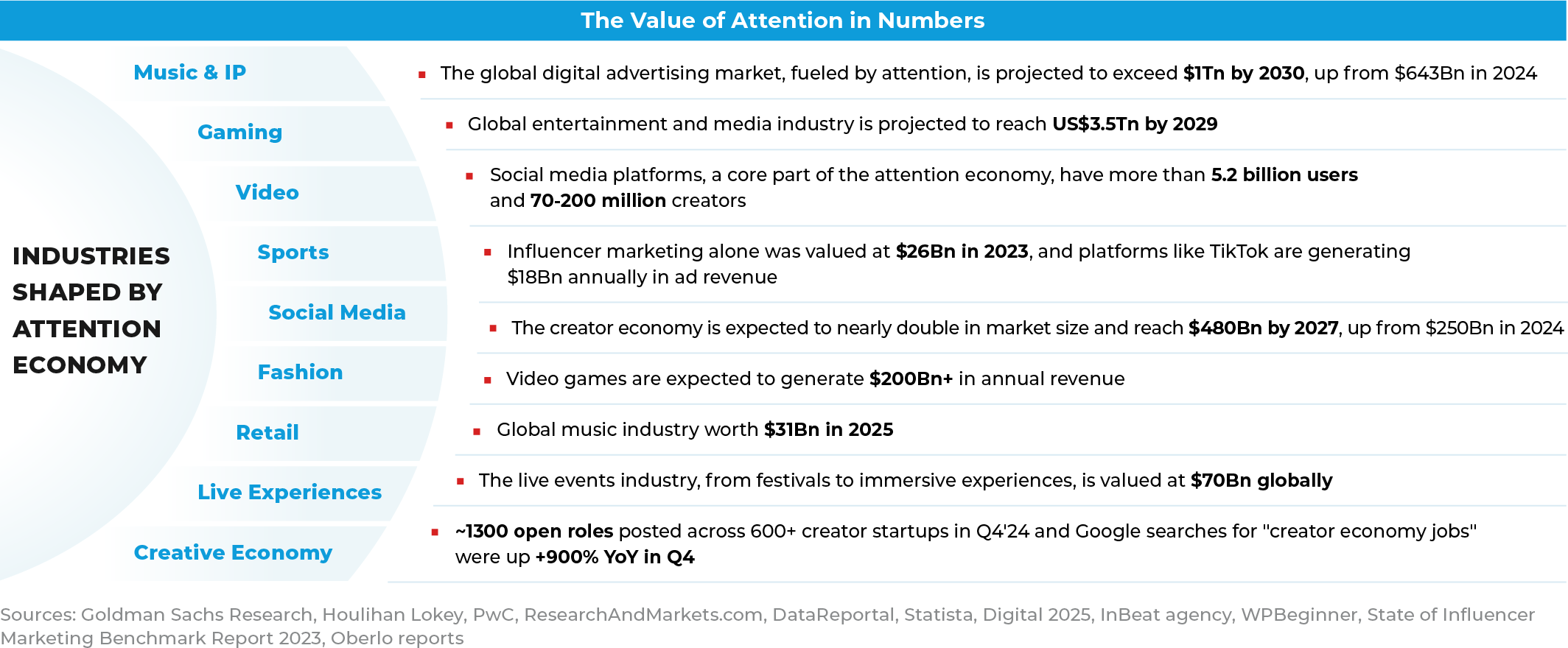

The attention economy is a vast and rapidly growing global market valued between $700Bn and $1Tn, driven by billions of users interacting across diverse media such as music, gaming, video, sports, social media, fashion, retail, live experiences, and the creator economy.

Originating from the rise of traditional social media in the early 2010s, this economy has evolved with increased influence for individual creators, a preference for user-generated content and rich media formats, and new monetization models that shift economics and ownership toward creators.

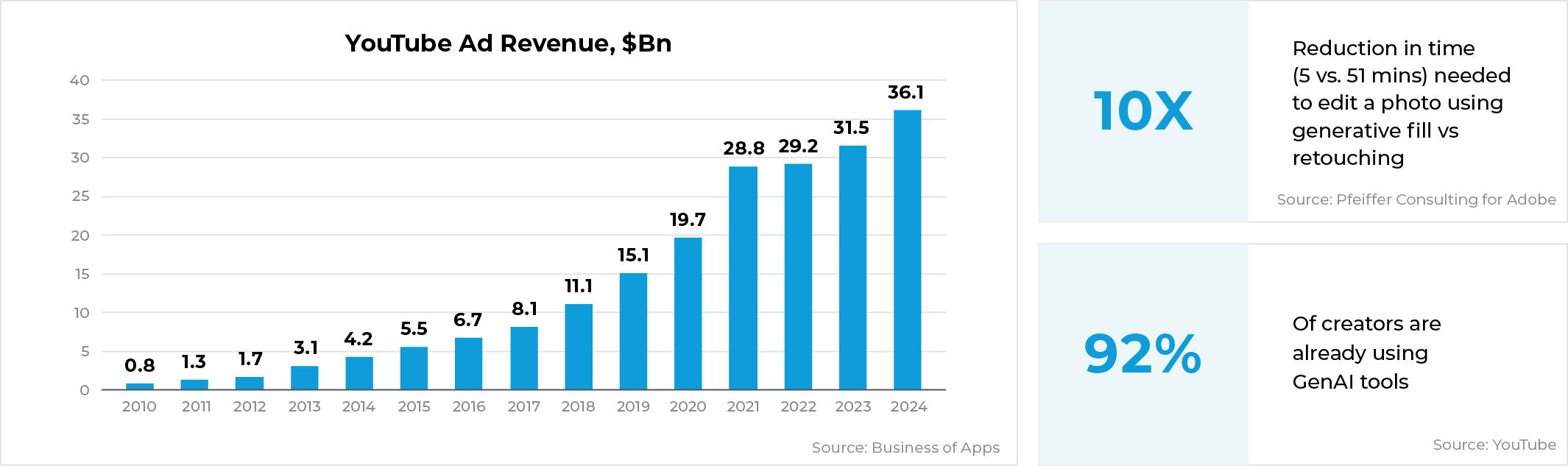

The incorporation of AI, especially generative AI tools and services, is accelerating this transformation by empowering individual creators to produce and monetize content more efficiently and at scale.

Web3 enables innovative economic models like tokenized fan engagement, creator royalties, and decentralized content ownership, the attention economy supports sustainable growth and deeper participation of creators and consumers in its ecosystem.

As the crypto market matures, attention economy applications offer scalable, user-centric financial systems that can drive widespread adoption and lasting impact within digital ecosystems. This positions Web3 as a foundational pillar for the future of the attention economy innovation and value exchange.

Investors & corporations have already recognized the importance of capturing people’s attention. Institutional capital is beginning to invest in sports, music catalogues, content creators and collectibles as an asset class.

We believe that opportunities to invest at the intersection of the attention economy and blockchain technology are plentiful now and will increase rapidly in the next several years.

The Attention Economy Is Everywhere

Attention is a currency. It is traded between consumers and creators. It is a finite, valuable, and a scarce resource. It is spent on content. It is monetized by creators (individuals, companies, AIs) through sales, ads, subscriptions, and platform fees. It is expended by consumers through their implicit use.

A large universe of companies has emerged to service these interactions and create lasting meaningful value for both sides - the consumers and the creators.

The attention economy is a concept introduced by Herbert A. Simon in 1971 that views human attention as a scarce and valuable resource in an information-rich world. It highlights that the real limitation is not information but the limited attention people can give, creating competition among many sources to capture and monetize this attention. The internet intensifies the competition for this scarce resource, making attention the core value driving economic activity online.

Attention becomes the foundation of wealth, fueled by speculation. In this sense, everything feels like crypto: it may not always represent “real” value, but it captures value through speculation, belief, and cultural momentum—what you might call vibes, volatility, and mindshare. We now live in a system where attention dynamics act as the underlying framework for how resources are allocated, political decisions are made, and identities are shaped.1

How big is the market?

1) https://kyla.substack.com/p/trump-mamdani-and-cluely

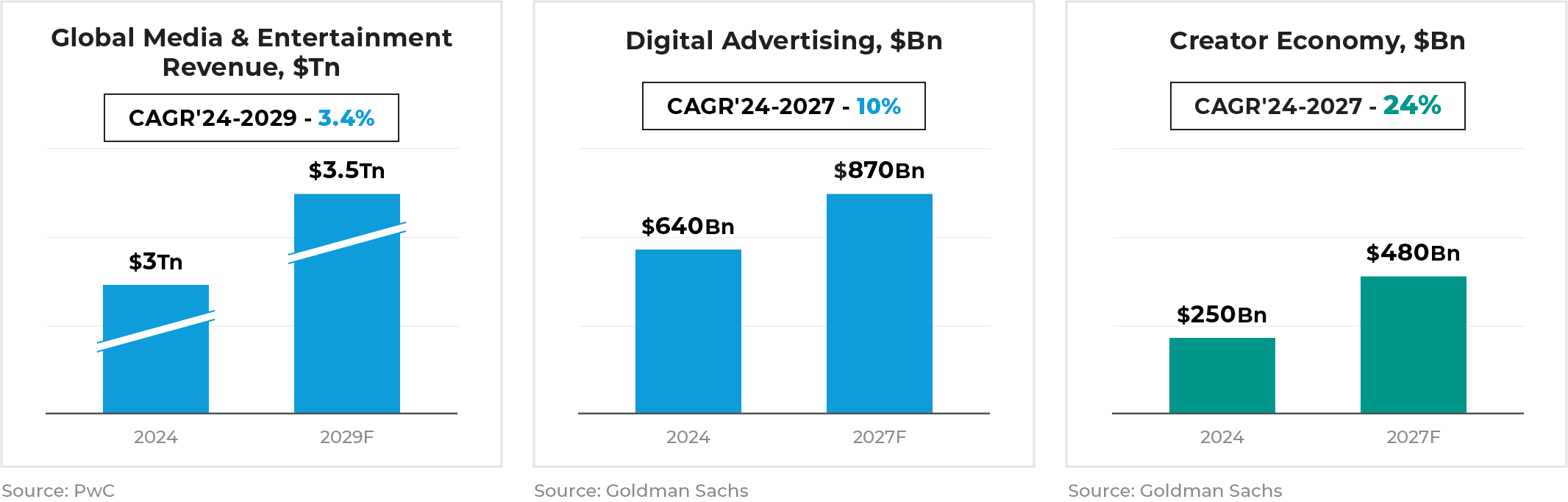

How Fast Is It Growing?

Now Is The Time To Invest In The Attention Economy

From Early Internet To The New Creator Era

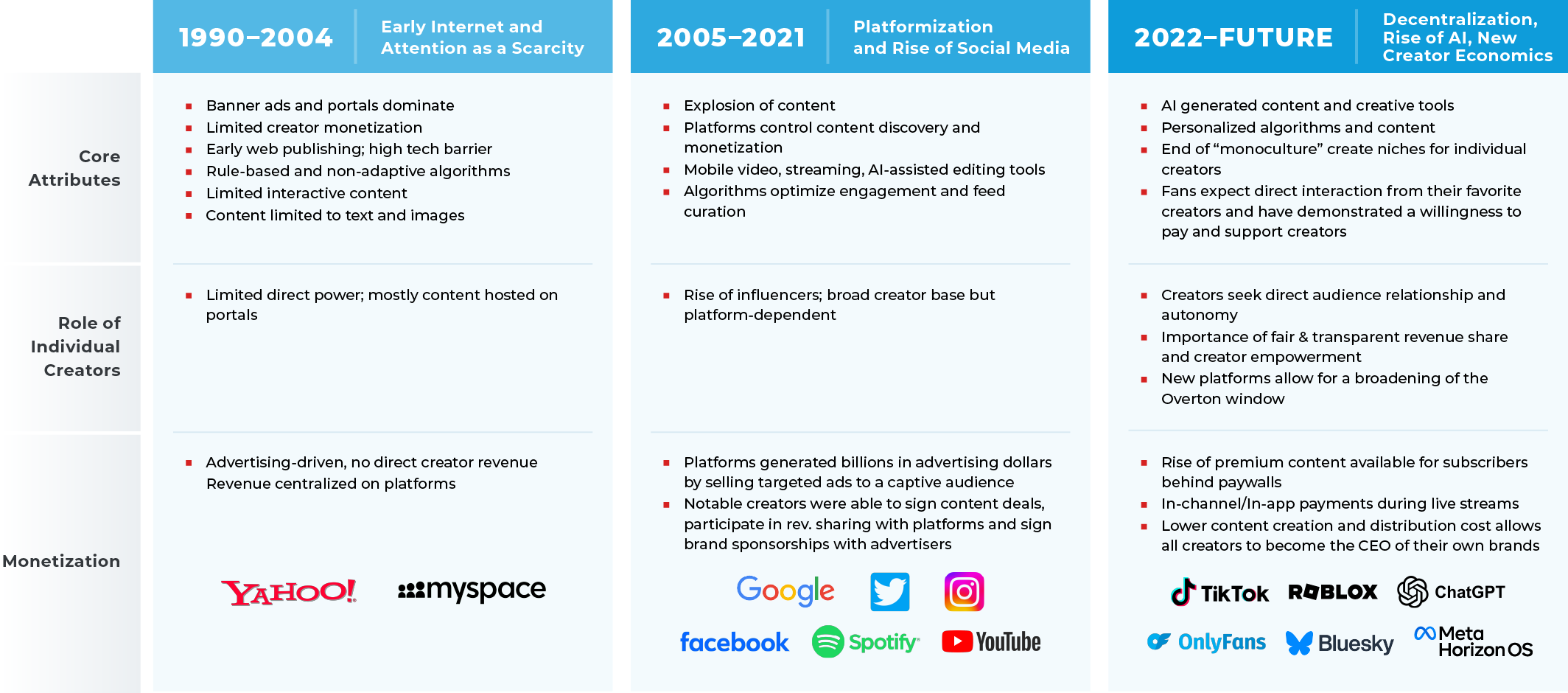

The Attention economy has been evolved since the early days of the Internet, driven by technological and cultural shifts.

Initially (1990–2004), attention economy had limited creator monetization tools, and content was mostly restricted to text and images with high barriers for individual creators. From 2005 to 2021, the rise of social media platforms brought platformization, allowing more creators but with monetization still centralized and driven mainly by advertising, curated by non-adaptive algorithms.

Today and looking forward (2022 and beyond), decentralization, AI, and new creator economics are transforming the landscape. Mobile video, AI-assisted editing, personalized algorithms, and lower content creation costs empower creators to become CEOs of their own brands. Fans increasingly expect direct interaction and are willing to pay creators, who seek autonomy and fair revenue shares.

New platforms broaden content diversity and support new monetization models, subscription-based premium content, audience-based monetization, and direct brand deals, shifting control and revenue to creators while expanding content diversity beyond a single mainstream culture.

Today, individual creators, established media firms, and major brands are producing more content than ever before, making consumer attention an increasingly valuable asset. This is reflected in robust private market investment: after peaking in 2021, funding for the creator economy startups surged again in 2024, reaching $1.5Bn and signaling renewed confidence in the sector’s potential. Total private market investment in the creator economy has surpassed $5Bn+ since 2022.

Blockchain and AI Mainstream Moment

Blockchain and AI open a new era for billions of creators and consumers, providing new tools and infrastructure and enabling creator independence and new economic opportunities. AI-driven tools are becoming smarter and fairer. Web3 has matured significantly, becoming increasingly well-suited for creators:

-

Faster & Cheaper Blockchains. High-performance blockchains now rival traditional payment systems in speed and capacity. Transaction cost have decreased by 90% allowing microtransactions to occur for less than $0.01.

-

Expanded Distribution & Reach. Creators can reach a global audience through the internet without requiring studios, labels or publishers.

-

Innovative Incentive and Monetization Models: Decentralized platforms and novel monetization models (ex. creator tokens with profit sharing) enable creators to retain a higher share of earnings compared to traditional platforms. New models can also deepen fan engagement.

-

Provenance, Efficiency & Transparency. IP ownership and content consumption is recorded transparently on a blockchain.

-

Seamless User Experience: Blockchain onboarding is now as simple as signing up for a new email account enabling access to billions of users.

-

Enhanced Privacy and Data Control: Blockchain technology empower creators and fans with full control over their personal data and IP.

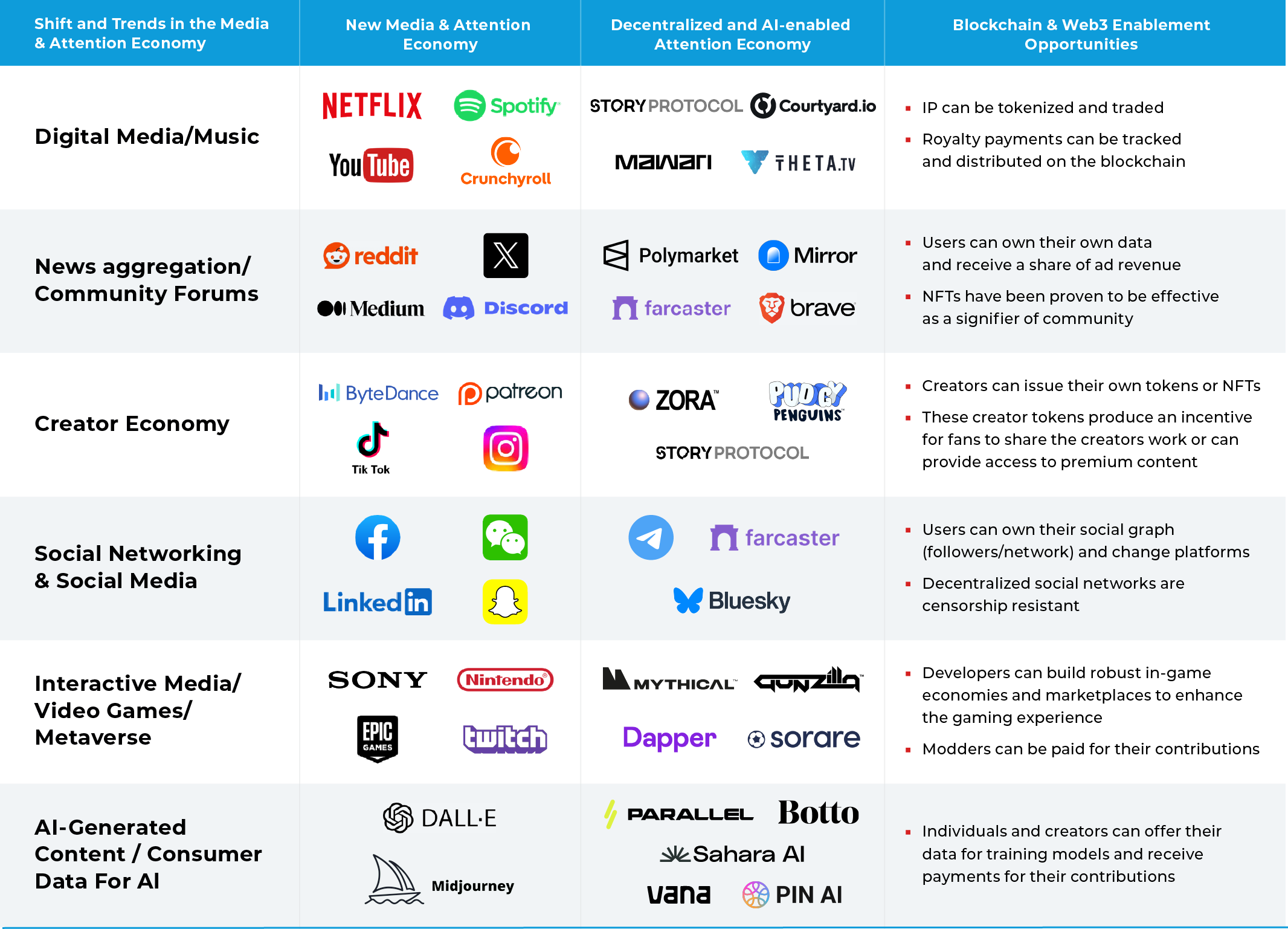

Powered by new blockchain and AI, plentiful new business models in attention economy are emerging:

New Business Models Of Attention-Driven Economy

What Sectors Of Attention Economy Are We Excited About?

At 10SQ, we are particularly excited about the opportunities in the following subsectors, providing necessary infrastructure and tools for the attention economy:

We believe that opportunities to invest at the intersection of the attention economy and blockchain technology are plentiful now and will increase rapidly in the next several years. According to Pitchbook, there are 14,000+ startups operating within the attention economy sectors that have raised $1MM+ in the last three years in a pre-seed, seed or series A funding round. Within this group, nearly 500 utilize blockchain technology in their business. We believe this investable universe will continue to increase each year as new startups launch and blockchain technology gets further adopted by the attention economy.

Case Studies: Blockchain Startups Transforming the Attention Economy

Overview: Polymarket is a decentralized prediction market platform where users can place bets on the outcomes of real-world events such as politics, sports, cryptocurrency, weather, and more. Polymarket gained mainstream attention during the 2024 U.S. presidential election for its accurate market forecasts. The platform emphasizes decentralized governance, user privacy, and no custodial control of funds, aligning with Web3 and DeFi principles.

Company Highlights:

-

$17Bn in cumulative volume has been traded on Polymarket as of August, 2025.

-

In August 2025, 214K users traded and over 119K markets were created.

-

Polymarket has become a data source referenced by media organizations when reporting on global events.

-

A $200MM raise at $1Bn valuation was announced in June 2025.

Blockchain: It operates on the Polygon blockchain and uses cryptocurrency (primarily the stablecoin USDC) for trading. The platform enables borderless participation and liquidity aggregation. Its acquisition of a U.S.-licensed derivatives exchange supports regulated compliance while maintaining decentralization. Plans for a proprietary stablecoin and decentralized governance empower community ownership and new revenue opportunities.

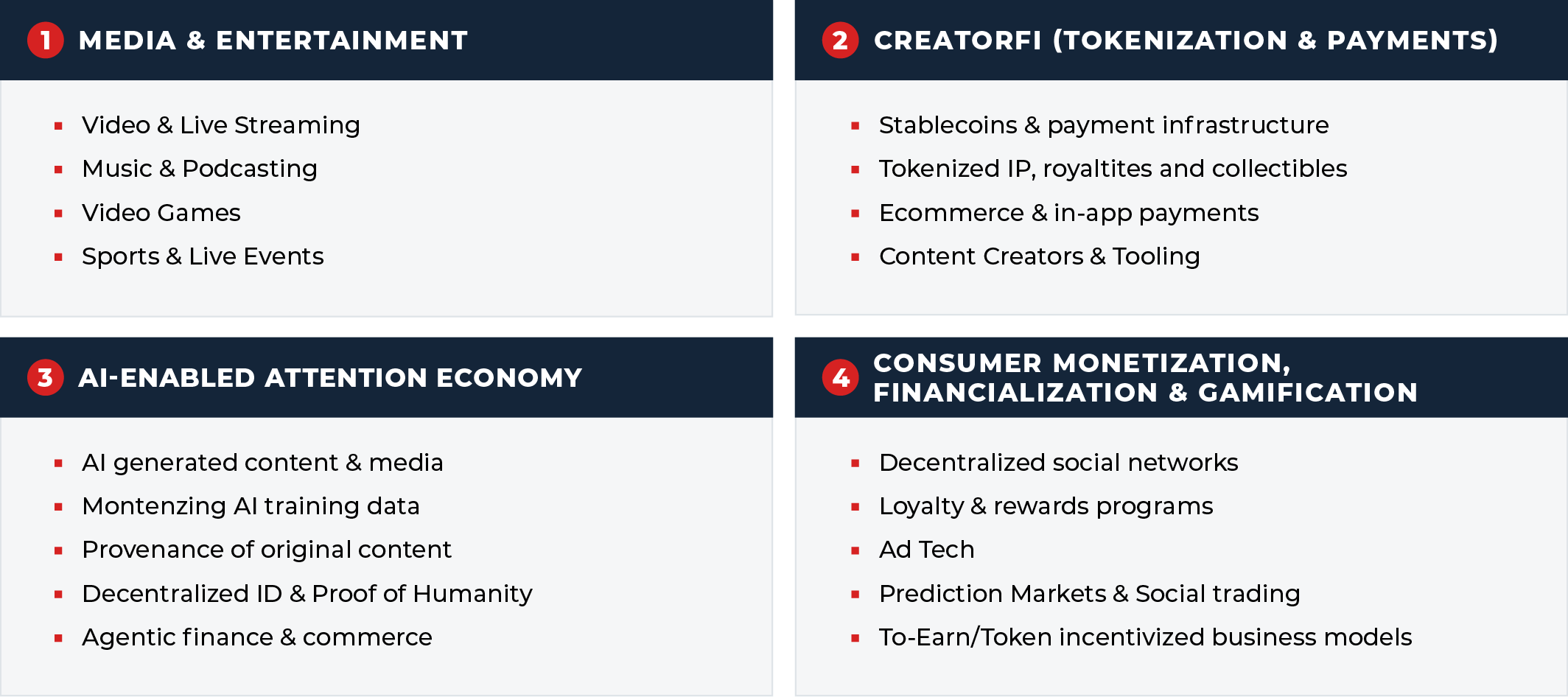

Overview: Courtyard.io, has pioneered the real-world asset (RWA) NFT model, linking digital tokens to physical cards stored in insured vaults. Trading cards are stored and tokenized at Courtyard’s storage facility. Tokenized cards can then be bought by users and traded in a P2P marketplace like eBay or sold back to Courtyard at 90% of the card’s FMV, addressing liquidity concerns in the physical collectibles market.

Company Highlights:

-

$50MM monthly GMV (1,000x growth since January 2024), and has sold more than 1 million Pokémon packs to date.

-

By Q1 2025, its revenue surged to $48MM, up from $9MM in Q4 2024—a 433% quarterly leap.

-

In June Courtyard.io has completed a $30MM Series A funding round led by Forerunner Ventures and involving NEA and Y Combinator.

Blockchain: Tokenization digitally represents a physical card on the blockchain, enabling secure trading. Stablecoins like USDC facilitate quick, low-cost payments. This process ensures card authenticity, reduces shipping risks and costs, and boosts global liquidity.

Overview: Brave Browser is a privacy-focused web browser that blocks ads and trackers by default, protecting users’ data while rewarding them with cryptocurrency (Basic Attention Token - BAT) for viewing privacy-respecting ads. It includes an integrated crypto wallet called Brave Wallet, which supports multiple cryptocurrencies and Web3 features without needing extensions, enabling users to securely manage and trade digital assets directly within the browser. Advertisers pay for ad space in BAT and users can be compensated in the token.

Company Highlights:

-

93M+ MAUs and 39M+ DAUs.

-

1.8MM verified creators use Brave and can receive tips in BAT tokens across platforms including YouTube, Twitter and Reddit.

-

Over 3,500 active ad campaigns with 400 advertisers.

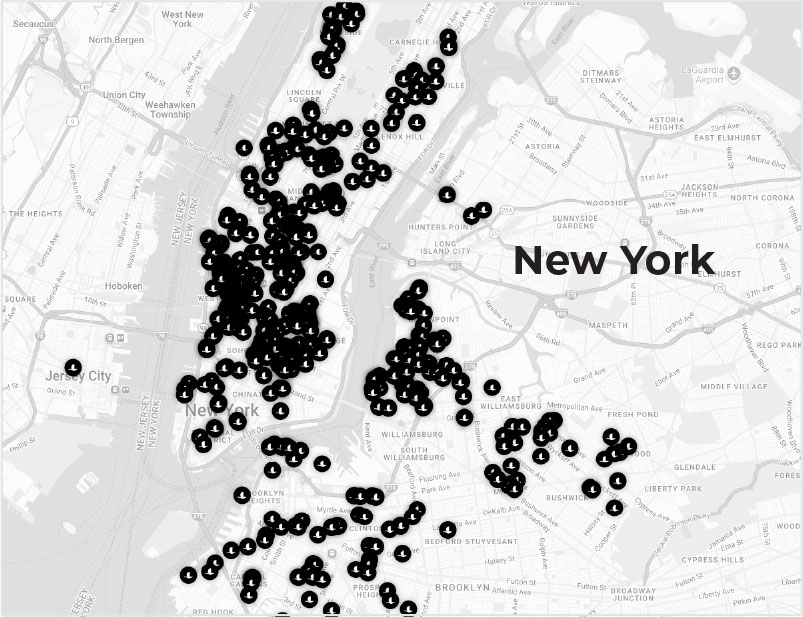

Overview: Blackbird is a blockchain-based loyalty and payment platform for the restaurant industry. Blackbird aims to increase restaurant profitability and improve customer engagement by creating a transparent, efficient ecosystem.

Company Highlights:

-

1,000 restaurants are using the Blackbird platform.

-

Restaurants are increasing margins by 3-4% when using Blackbird.1

-

The company secured $50MM in funding for its blockchain-powered restaurant payment and loyalty platform from Spark Capital, Coinbase Ventures, Amex Ventures, and Andreessen Horowitz.

Blockchain: Blackbird allows users to earn rewards and pay bills through its app, built on the Base blockchain. Blackbird’s own Layer 3 blockchain, Flynet, records transactions on-chain, reducing costs by eliminating intermediaries. The platform uses two tokens: "fly" points for spending and rewards, and the F2 token for governance and revenue sharing. Customer profiles are stored on the blockchain and owned by the customer and shareable to all restaurants in the network.

1) Not Boring by Packy McCormick, The Token Dispatch, The Blockbeats, and TechCrunch

Sources: websites and press releases by Courtyard.io, Polymarket, Brave

This report is a product of the TenSquared Capital (10SQ) research team.

TenSquared Capital (10SQ) is a venture capital firm investing in the Attention Economy, where Media, IP, and Technology intersect.

Important Disclosures

This publication is an informational document only and is intended to provide educational content and general market commentary, and should NOT be relied upon as legal, business, investment, or tax advice. Furthermore, the content is not directed at nor intended for use by any investors or prospective investors in any TenSquared Capital LLC (“10SQ”) managed funds. Please visit tensquared.com/disclosures.html for additional important details and disclosures, including link to list of investments.